A simple method for calculation, pricing and controlling

Richard Lammers explains a new management method in an interview

How successful are orders in reality? This was the question posed by Richard Lammers, management consultant at MSB Management-Service-Beratungsgesellschaft mbH. It’s hard to give a simple answer to such a complex question. To simplify this, he developed the Lammers Quotient. In an interview with Parm AG, Lammers explains the background.

Parm: Mr Lammers, what inspired you to develop the Lammers Quotient?

Richard Lammers: As a management consultant, I have been involved with the tasks of corporate management for many years and have thus implemented numerous projects in the areas of corporate planning, costing and controlling. In doing so, I have always noticed how much time is invested in providing corporate planning with necessary target-performance comparisons. Calculations and prices are often based on outdated figures and employees sometimes use different price models as well as software with different calculation bases.

This approach not only makes pricing non-transparent, but also makes it difficult for management to recognise whether an order is profitable. I have developed the Lammers quotient so that not only the management but also the employees can make better financial decisions.

P: Many companies use overhead calculations as a basis for pricing. Where do you see the weaknesses here?

L: On the one hand, purchase prices change quite quickly, which means that the material and goods inputs are often variable. This poses the danger that prices could be set too low, so that an order does not bring in enough profit. On the other hand, prices can be set too high, which means that profitable orders can be lost.

P: Have you often experienced such situations?

L: Yes, especially with a potential order of high value. If there is no sufficient basis for analysis and evaluation, this can lead to losses in the profit and loss account or even to company insolvencies. This is usually due to the fact that in such a case too many staff hours or performance resources are used for unprofitable projects, and in return they are lacking elsewhere for more profitable projects.

P: How can the Lammers Quotient help with this dilemma?

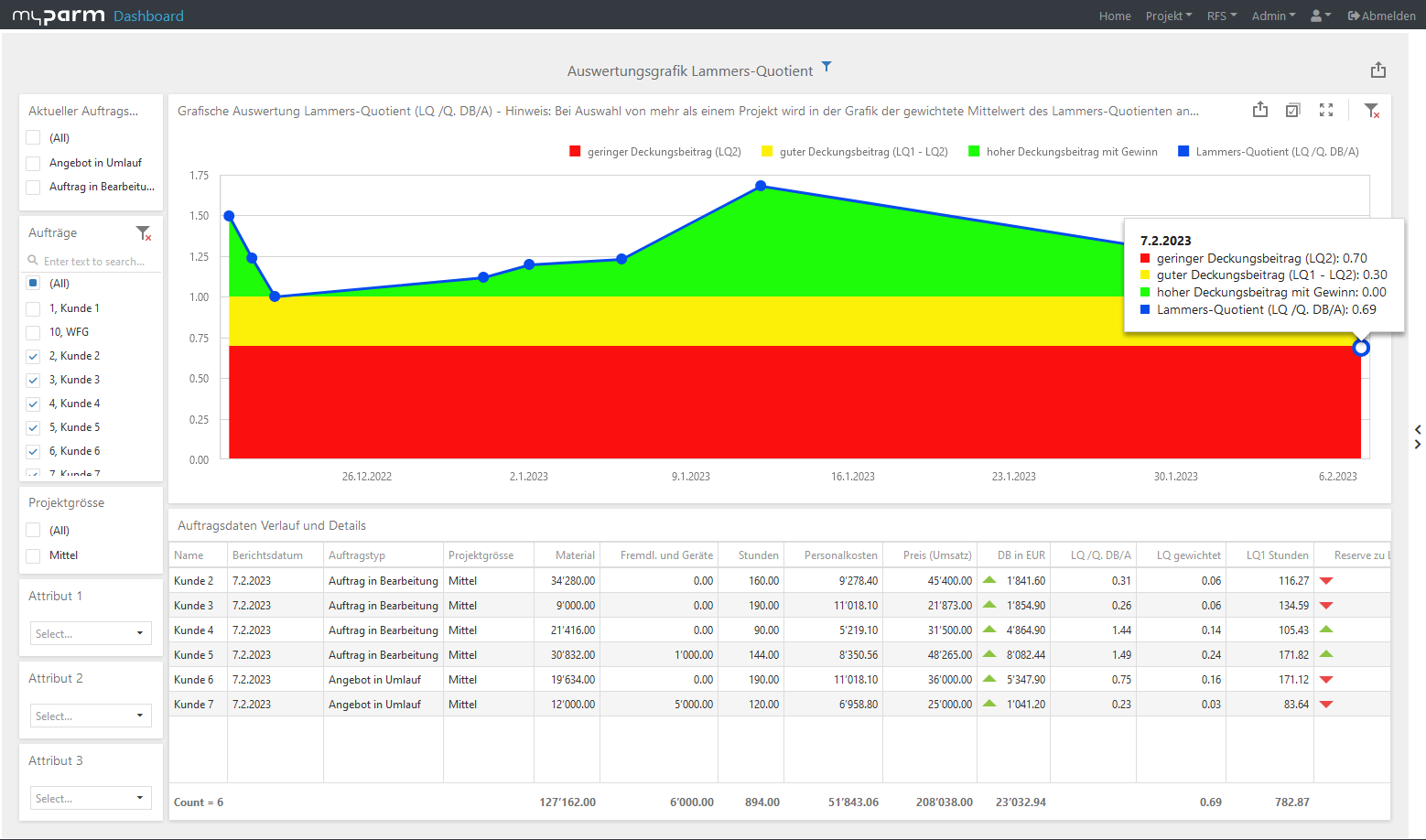

L: The Lammers quotient combines the contribution margin with the utilisation in one key figure. The core elements are, on the one hand, the available performance hours and, on the other hand, a company-specific order interpretation. In this way, the profitability of an order can be calculated and visualised.

P: What exactly does the result of this calculation mean?

L: The rule of thumb is simple: values above 1 are good, i.e. orders in this range have a high contribution margin and high profit shares. Values below 1, on the other hand, are not good. In order to be more precise, this range is subdivided again, whereby the standard threshold value of 0.75 can be adjusted according to the individual approach in the company. Values in the upper range of this mark orders with high contribution margins and low profit shares, while values below the threshold indicate that an order has a low contribution margin.

P: You have tested the Lammers quotient in different companies. What experience did you gain from this?

L: It has become apparent that the overhead calculation for short- and medium-term projects usually has a good calculation basis, but long-term projects with a high proportion of staff often slip into a range below 0.75. The Lammers quotient can be used to calculate at what number of staff hours a project leaves the optimal green range or even slips from the yellow to the red range. This makes it easy to recognise at what point such projects are no longer profitable.

However, I have also noticed that it is important to look closely at the green area. It is not uncommon for the values here to be as high as 5 or 6. In such cases, it is important to make sure that the customers’ willingness to pay is maintained. It is therefore worthwhile to pay special attention to customer satisfaction in such projects in order to remain profitable in the future.

P: What key figures are needed to calculate the Lammers quotient?

L: Apart from the data that are important for a normal calculation, you only need a planned cost calculation for the coming or current year, which includes the planned hours of the employees. This means that for pricing you need the material and goods inputs, external services, machine and equipment costs as well as the working hours of the employees for a project. For orders in stock or in progress, the turnover or activity status is also required. Fed with these five figures, the Lammers quotient immediately shows you which orders are disproportionately profitable and which are not.

P: What can you do with the knowledge gained in this way?

L: First, you can prioritise orders or projects and work towards getting rid of or no longer accepting those in the red zone. In this way, you can subsequently let your employees work on orders that have a high contribution margin and profit share. I have seen the profitability of the order book increase between 10 and 50 per cent in this way.

The Lammers quotient can thus provide important insights for a company, help in setting optimal prices, make calculation errors visible and be used as an early indicator for the profitability of projects.

Thank you very much for the interview!

Conclusion

Would you like to test the Lammers Quotient and use it in your company? In cooperation with Parm AG, the myPARM LQ ProfitGuard software was developed specifically for this key figure. It can easily and quickly evaluate quotations and orders; regardless of whether they are quotations in circulation, orders in stock, in process or even orders that have already been completed. A task management with a Kanban board is integrated so that you can immediately turn insights gained into measures. The additional document management allows you to store all important information in one system.

Learn more about the new myPARM LQ ProfitGuard software:

Would you like to get to know myPARM LQ ProfitGuard in a demo? Then make an appointment with us right away!